Morning Star Candlestick Pattern: How to Use in Trading

Morning Star pattern is a Japanese candlestick pattern. This candlestick pattern usually appears at the end of a downtrend. It is the starting point for the uptrend of prices. Mastering this entry point will help you open options with a high win rate.

Morning Star pattern is a Japanese candlestick pattern. This is a chart pattern which mostly appears at the end of a downward trend. It is the starting point for the upward trend of prices. Candlestick patterns appearing on the price path have long been carefully studied by investors. This is the basis for making future forecasts based on this assumption that trade signals are ahead.

To enter a trade, you should pay attention to Morning Star candlestick pattern. This candlestick pattern usually appears at the end of a downtrend. It is the starting point for the uptrend of prices. Mastering this entry point will help you open options with a high win rate.

Morning Star is a Japanese candlestick pattern. It appears at the end of a downtrend. It is the starting point for the uptrend of prices. Mastering the entry point will help you open options with a high win rate.

Candlestick patterns appear often on the price chart, and they’re really hard to understand. But it’s not hard if you learn how to read them. For example with Morning Star pattern, it can be interpreted that prices usually go up after this pattern. Mastering this entry point will help you open options with a high win rate.

The Morning Star pattern, also called Marubozu in Japanese, is a Japanese candlestick pattern. It usually appears at the end of a downtrend. This candlestick pattern is one of the most effective price signals for a trend reversal.

Have you ever wondered what types of candles appear on charts and why do they appear? If so, this article series is for you. We will start with one of the most important candle patterns that indicates a reversal in price movement. It is Morning Star.

This candlestick pattern was first identified by a Japanese analyst named Kazuo Yamamoto, hence the name Morning Star. It appeared in the S&P Nikkei 225 Futures chart in 1979. The pattern is known to predict an upwards price trend and it signals that after the decline, a bullish condition will return. The Meaning of the Morning Star Pattern The morning star pattern is a trend reversal signal. It means that after a downtrend, upward momentum will start to form into a trend reversal. This is why it is called the morning star because it appears at the end of a downtrend when everyone has given up on the market as bearish and has sold their shares causing prices to fall.

Morning Star is one of the best patterns, which signals a trend reversal, MCX silver. It has the ability to find important turning points in the market, and indicates the presence of further operations to higher highs.

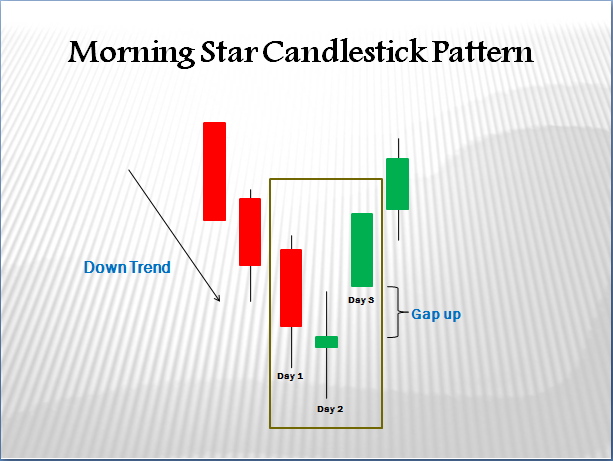

The Morning Star pattern is popular in the analysis of foreign exchange (FOREX) and stock, and is a major reversal pattern after a decline or fall. It is considered as a three-phase pattern that occurs at the end of bearish trend.